The Power of B2B Pricing: Pricing is the New Hidden Factory

Introduction

In the aftermath of the Great Recession of 2008, as firms faced a plummet in aggregate demand across multiple industries, company executives sought to stay afloat by streamlining their businesses and drastically reducing costs. Such tactics alone, however, are insufficient to solve growth challenges and margin leakage. As the spread of the novel coronavirus COVID-19 continues to disrupt the normal course of business around the globe, it is, once again, a significant challenge to forecast demand, predict outcomes, and maintain profitability. The crisis has laid bare the broader bifurcation of business performance in the B2B space between winners who act nimbly to capture the value they provide and those who are struggling to realize their profit potential. Sophisticated Pricing capabilities are often the ultimate difference maker. Therefore, it is critical that Chief Executive Officers find and recruit leaders who can design and execute pricing excellence disciplines. Pricing leaders provide firms with cross-functional tools and expertise to optimize P&L performance, and can answer some of the most difficult commercial questions companies face:

- How do I win business without leaving money on the table?

- How do I set the right price in ambiguous situations?

- Who influences and is held accountable for pricing effectiveness?

That’s why Raines International, one of the United States’ premier talent consulting firms, and INSIGHT2PROFIT, an industry-leading Pricing & Profitability Solutions Firm, joined forces: to (1) explain this trend, (2) identify what it takes to evaluate talented Pricing leaders, and (3) outline how these leaders grapple with the following realities:

- Small differences in price have an outsize impact on the bottom line.

- Pricing information, good and bad, is more available than ever.

- Market dynamics are speeding up.

- Pricing has many masters, but no single owner.

- Pricing is multi-faceted in the B2B space.

- B2B organizations routinely fall short on pricing due to historically misguided behaviors, leaning on intuition rather than data.

- Cutting costs alone cannot create growth or solve for a growth problem, making pricing strategy one of the most valuable tools in creating shareholder value.

Pricing is a Team Sport

What should the team captain look like?

In a Private Equity ecosystem where executives are increasingly wearing multiple hats, a successful Pricing strategy requires clear reporting structures with defined ownership and accountability. Pricing strategies must account for cross-functional incentive structures that are sometimes at odds with each other. For example:

- Sales teams are typically incentivized by driving volume and meeting revenue quotas and may be inclined to negotiate deals with lower prices to protect critical and long-lasting client relationships. In this setting, knee-jerk price reductions are an overused lever by a sales force.

- Finance teams typically keep investors top of mind, making determinations that achieve margin targets regardless of broader consequences.

- Operations teams focus on cost estimation and / or commercialization, potentially opting against market-value pricing if it appears to create barriers to certain marketplaces.

- Marketing teams may push to lower prices to achieve increased customer acquisition in the short term while decreasing lifetime customer value.

All of these well-intentioned efforts can lead to money being left on the table. Pricing leaders deliver value to their organizations by targeting certain key priorities and executing against their competing incentive structures. How?

Align Pricing strategy and Company strategy. Pricing strategy must align with the overall goals of the business. Whether the objective is to maximize unit profitability, grow market share, attract specialized customer segments, or appeal to the mass market, the “right” price will produce value insomuch as it tracks with larger business goals.

Establish scalable and durable processes, reporting, and infrastructure. Insightful, timely measurement and reporting of pricing impacts are necessary to drive continuous improvement. A common misunderstanding is the concept of “pricing as a project.” While short-term pricing initiatives such as price increases or introducing new software capabilities can unlock hidden value, pricing excellence is only achieved when it is embedded into the DNA of a business’s operations through a seasoned leader and the right processes and technologies to enable an ongoing center of excellence.

Develop a Pricing strategy that recognizes and navigates the unique dynamics of your business and markets. Pricing is inextricably related to the products, technologies, competitors, regulatory environment, and market realities of a specific business. There is no “one size fits all” roadmap.

Support the Pricing strategy with the right action plan. Effective pricing requires a sound strategy, but the value capture is achieved with specific tactics, behaviors, and interactions that strengthen accountability internally and build trust with customers externally. Pricing experts must therefore be Difference Makers®, change agents who embrace a disciplined, data-driven, and analytical approach. Just as importantly, Pricing leaders must be influencers that lead an organization through the necessary structural changes to achieve pricing excellence.

Depending on the needs of your unique business, the ideal Pricing leader will be someone with a compelling track record in pricing strategy, execution, transformation, optimization, or any combination of the above. As such, Raines International leverages technical expertise and world-class recruitment processes to evaluate candidates according to the following Pricing Leadership Scorecard:

- How did they build a pricing toolkit over time?

- Management Consulting: In addition to specialty firms with deep focus and expertise within pricing such as INSIGHT2PROFIT, management consulting organizations such as McKinsey, Bain, BCG, PwC, and others provide first-class training in commercial excellence across various industries. Consultants harness an analytical toolkit and sense of urgency that enable them to thrive in ambiguous environments, making them adept problem solvers and cross-functional influencers.

- Blue Chip / Academy Companies: Global B2B companies such as Lockheed Martin, Grainger, and Danaher are renowned for instilling best practices in their workforces. Such firms feature developmental and rotational programs that provide exposure to multiple areas across complex businesses. Unlike most management consultants, industry-grown Pricing leaders have executed their strategies and should be able to point to metrics illustrating their personal impact on profitability.

- What is their ability to influence stakeholders, successfully implement cross-functional initiatives, and achieve widespread buy-in? Great Pricing leaders understand that various functional teams contribute to a firm’s Pricing strategy, and that those teams may have competing incentive structures.

- Whether your candidate is a current management consultant or an industry veteran, change management is crucial. Charisma and professional gravitas are important ingredients for any successful executive, but those qualities alone will not ensure a successful pricing implementation. Pricing executives must harness data and create actionable plans that give stakeholders confidence to take a different approach, even if it may cause short-term pain.

- If applicable, has the candidate built a Pricing function before? This is often the most urgent need for Private Equity- and Venture Capital-backed firms looking to scale quickly.

- In previous roles, what was the “Pricing IQ” of the team / organization prior to the candidate joining?

- Who championed Pricing transformation (e.g., cost-plus à value-added), and what, if any, stakeholders resisted it? How did the candidate gain buy-in?

- What structural changes did the candidate implement, and how did those changes impact performance?

- Did this individual identify and leverage new technologies to facilitate innovative pricing execution strategies?

- Additional topics: Did the candidate… ?

- Conduct or participate in commercial due diligence to identify or integrate acquisition pipelines?

- Stop / prevent margin leakage?

- Improve the effectiveness of the Sales teams?

- Make a meaningful impact on top-line revenue growth?

Building and Executing a Pricing Strategy

How does your new Pricing leader effect change?

Costs are a critical consideration in any Pricing strategy, but customers also make decisions based on value. Even when customers demand a detailed account of a supplier’s cost while negotiating the price that they will pay, that interest is still in the service of trying to drive to the lowest price that they can achieve. While such a “cost-plus” methodology does have a few benefits (including avoiding selling at a loss, the freedom to adjust prices quickly in response to cost changes, and providing an easy heuristic for the sales force to follow, etc.), it has profound shortcomings that undermine overall profitability. To illustrate a primary pitfall, consider the following example:

The price of comparable coffee or beer varies depending on the situation. There are likely some differences in the per cup cost for each provider in the examples above, but it is small compared to the expected price difference, which ranges several hundred percent. This is because the value proposition to customers is different across the horizontal axis. Cost-plus thinking does not capture market price and customer value factors, a critical consideration when seeking price optimization.

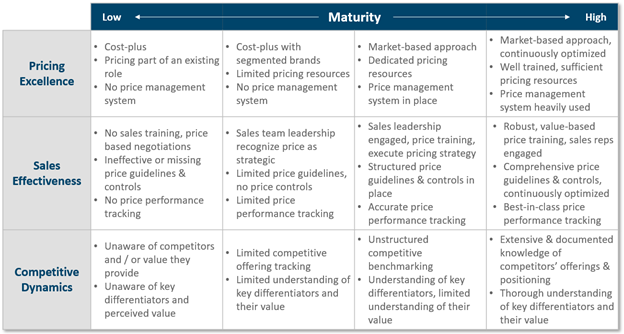

There is a broad gap between cost-plus thinking and full market-based pricing, with multiple weigh stations along that continuum. The graphic below summarizes some of the characteristics observed as we travel from low to high pricing and commercial acumen.

Conclusion

Whether your company is impacted by a bear market or a bull market, faces headwinds or tailwinds in a particular industry, or is just looking to maximize profitability on a unique offering, Pricing strategy and execution is the ultimate Difference Maker. To thrive in an ever-increasingly competitive global market, Pricing leaders are capable of instituting value-added pricing that can elevate a firm’s business strategy from Checkers to 3D Chess. Raines International and INSIGHT2PROFIT are here to help.

Who We Are and How We Help

RAINES INTERNATIONAL is a talent consulting firm committed to making a difference with executive search, organizational management, and talent management solutions. Raines is headquartered in New York City with eight offices across the Americas. Raines specializes in senior-level leadership placements across industries and functions.

INSIGHT2PROFIT combines expertise and technology to deliver sustainable and incremental growth to Manufacturers, Distributors, Consumer Goods Producers, and Business and Consumer Service Providers, through optimization of strategic pricing, product offerings, and sales effectiveness. INSIGHT has delivered over $1B in incremental EBITDA across a wide range of industries and market situations, partnering with global Private Equity firms and their portfolio companies, C-Suite company executives, pricing and product managers, and sales leaders to execute meaningful and sustainable bottom line improvements.