Industrial Real Estate: The Hottest Real Estate Sector in 2021

Consumers’ increased online shopping and delivery needs have upended the traditional commercial real estate market, leading to the industrial and logistics space quickly becoming the hottest sector. Raines International spoke with dozens of executives about the state of the Industrial/Logistics real estate sector to take the pulse of the industry.

As an owner, leasing to a retail brick-and mortar operation is often riskier than renting to an industrial client, evidenced by the past 12 months when many businesses have closed or pivoted to online fulfillments. With every facet of supply chains adapting and advancing in response to the pandemic and shutdowns, shifting real estate needs (including a greater need for cold storage for grocery and pharmaceutical merchandise and a renewed focus on domestic production and availability) have forced the industry to re-prioritize.

A few key themes dominant in the industry:

- The last mile. The last mile of distribution is becoming even more important as companies compete with Amazon and its infrastructure to meet sky-high demand for fast delivery. Companies need more warehouse space in each major market—not just New York and Los Angeles, but also Charlotte, San Antonio, and Omaha. Smaller hubs and micro-fulfillment help expedite delivery but have traditionally been overlooked. Micro-fulfillment and micro-hubs are already being used prominently abroad, with companies like UPS touting both their sustainability and logistics benefits. Walmart’s international micro-fulfillment operations allow it to have very fast turnaround times, with 60 and 90-minute delivery in China and Chile. Walmart International boasted a 97% increase in e-Commerce sales during 2020. Major retail companies including Gap, Williams-Sonoma, and Home Depot are now investing in industrial warehouse and distribution space to increase their distribution network and processing, as spaces like golf courses and malls are converted to serve new needs. Real estate logistics firms are growing quickly in prominence and investments, from Prologis (aka “Amazon’s biggest landlord”) to Goodman to PGIM.

- Staying a step ahead of technology and other needs. The pandemic accelerated the adoption of new technologies to meet consumer demand. Now, leaders should be looking at the next technology rollouts, how they may improve supply chain processes, and what plans must be in place. Will drones really help with the final stages of delivery? What about driverless cars or 3-D printing? Decisions on how to handle parking driverless cars, quality control, port accessibility, cybersecurity and beyond will determine future needs. Demand for cold storage – or the ability to freeze or temperature control inventory – is continuing to outpace supply, but presents an additional issue as it costs significantly more to build. Tied to the increase in home cooking, reliance on frozen food, and stockpiling during the pandemic, cold storage sales volume increased 22% in 2020.

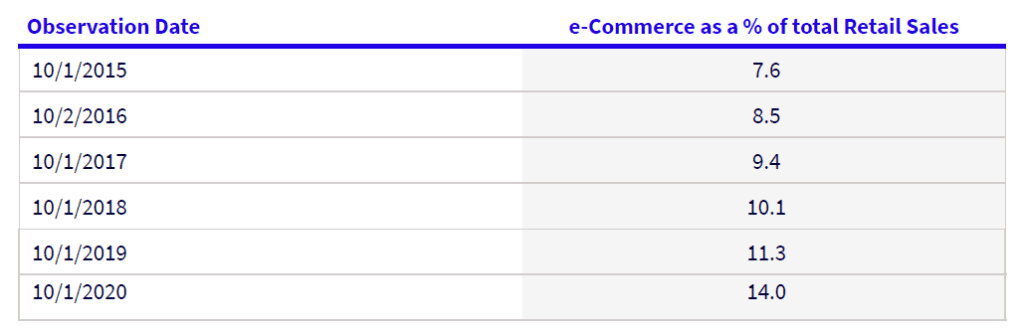

- e-Commerce is overtaking brick-and-mortar retail. e-Commerce stores will have more inventory needed at more locations, evidenced by the skyrocketing demands for e-Commerce, warehousing, and storage. Companies must prepare to handle everything including storing, shipping, and handling returns in industrial spaces. Pre-pandemic, the U.S. commercial real estate services firm CBRE found that “From 2019 to 2023, our model estimates the demand for an additional 850 million square feet of industrial real estate in the United States—or, in practical terms, roughly the amount of industrial real estate space available in Atlanta and Salt Lake City put together.” The pandemic only increased the desire for more industrial space.

What does this mean moving forward?

The development side will be moving fast, and e-Commerce will continue to thrive as millennials remain in their prime spending years. As companies need faster delivery speed and improved supply chain logistics, the space should prepare for disruption and seek creativity in transitioning office space, brick-and-mortar stores, and other dwindling real estate prospects to fill the rising demand for industrial real estate.

Sources: CBRE Research; Adobe Analytics; Deloitte

e-Commerce vs Brick-and-Mortar

Source: Federal Reserve Bank of St. Louis

“Amid the COVID-19 crisis, the global market for Cold Storage Construction estimated at US$7.9 Billion in the year 2020, is projected to reach a revised size of US$19 Billion by 2027, growing at a CAGR* of 13.4% over the analysis period 2020-2027.”

Source: Research and Markets

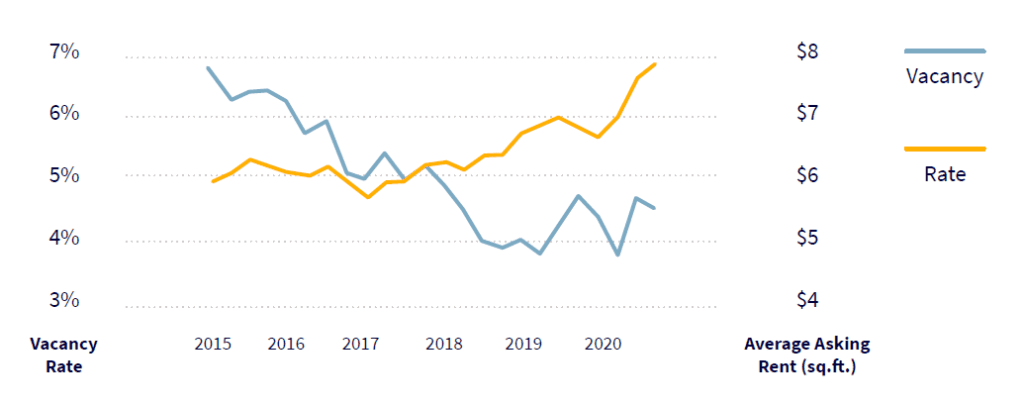

Tight Conditions Boost Cold Storage Rents

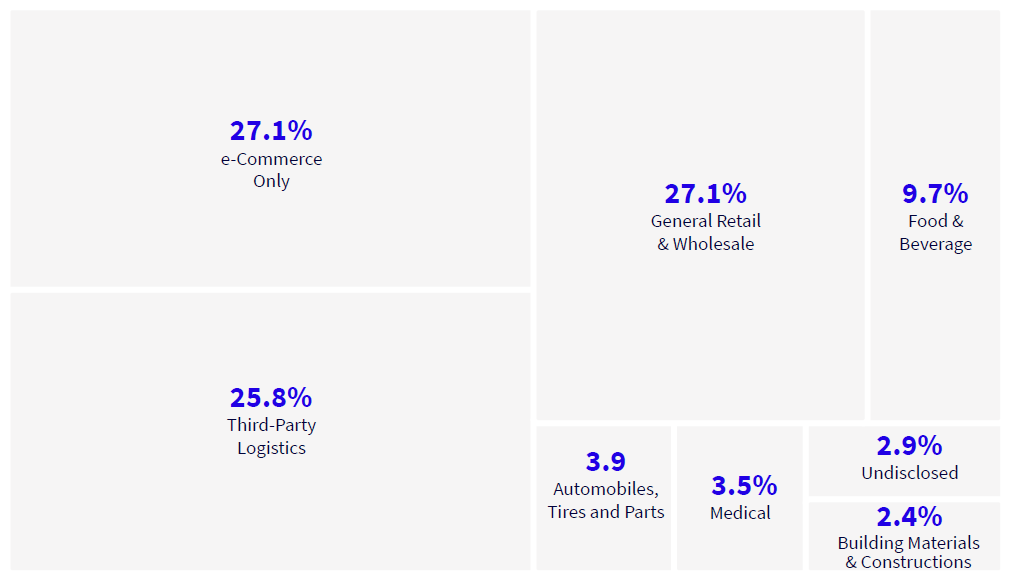

Market Share of Transactions by Occupier in 2020

Source: CBRE Research

*Stats above for 200,000 square feet+ spaces in top 22 markets

Engy Lamour is a Senior Vice President at Raines International and Meghan Dumser is a Consultant. For more information on this white paper you can contact the team here.